Increased Activity and Investment in Core Practices

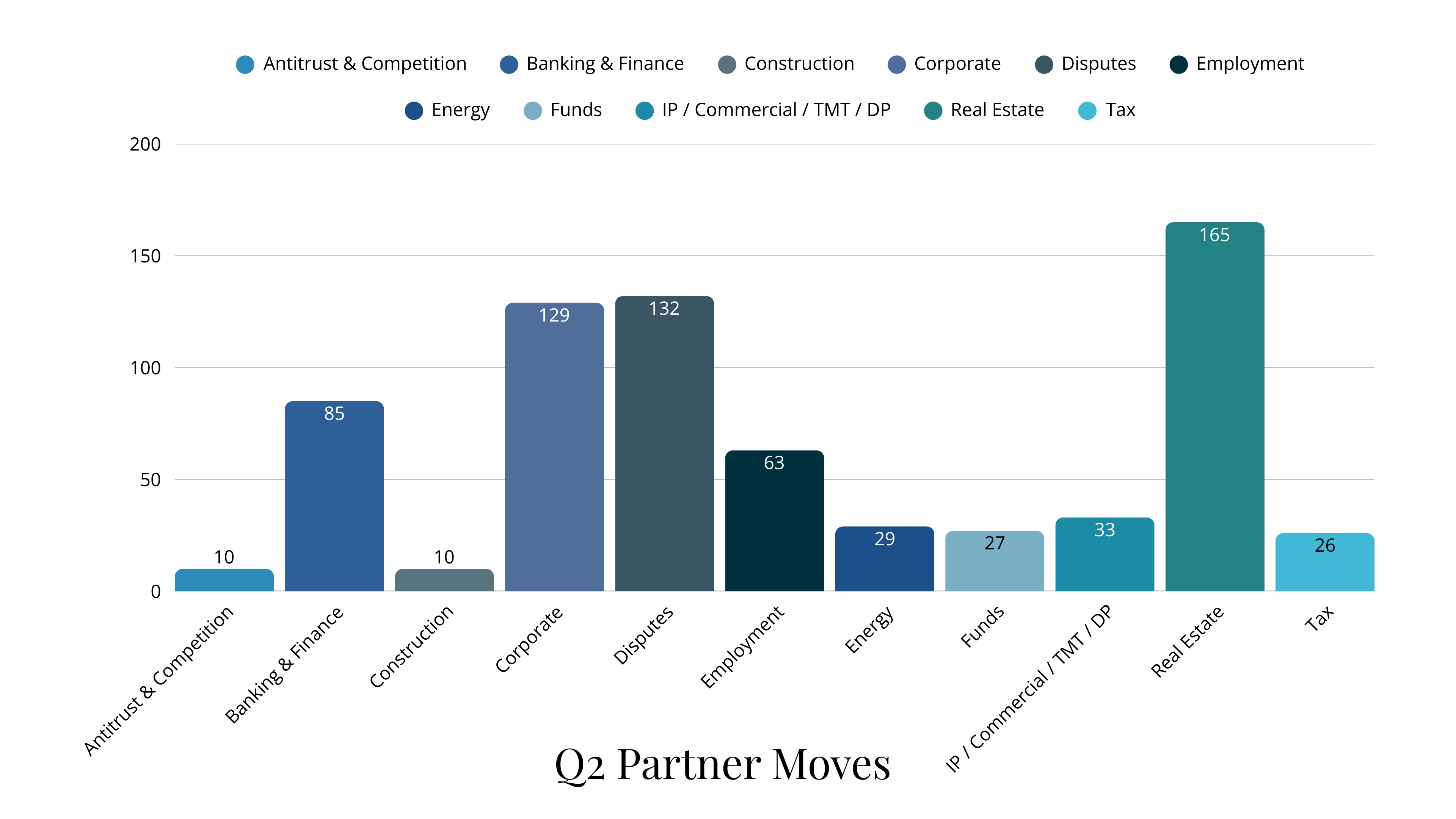

The second quarter of 2025 marked the most active period of the year for partner movement, with 709 partner moves recorded across UK and international private practice platforms. The increase in activity was broad-based, but most pronounced within Real Estate, Corporate and Disputes, reinforcing their status as core practices for firm leadership and revenue generation.Q2 activity reflected a willingness among firms to move decisively where confidence in demand and strategic alignment was strongest. For many firms, this was the point in the year where earlier planning translated into execution at scale, particularly where leadership gaps had been identified or where client demand was sufficiently clear to justify investment.

Real Estate recorded the highest volume of partner movement during the quarter. This activity extended beyond traditional transactional work and was largely driven by demand for partners advising on complex asset structures, financing arrangements and cross-border matters. International firms continued to prioritise individuals with the ability to operate across jurisdictions and asset classes, reflecting the increasingly integrated nature of real assets work.

Corporate hiring also increased materially in Q2. Among US firms, much of this activity focused on refining and strengthening UK platforms through targeted additions rather than pursuing broad expansion. The emphasis was on partners who could contribute immediately to existing teams, manage institutional clients and support cross-border mandates, rather than on building scale for its own sake. Magic Circle firms showed similar selectivity, with appointments often linked to leadership depth and succession rather than volume growth.

Disputes activity remained strong throughout the quarter, supported by complex commercial litigation, regulatory investigations and cross-border contentious work. The sustained level of disputes hiring reflects its continued importance as a stabilising practice for firms advising in uncertain and highly regulated environments.

Partner promotions peaked in Q2, with 454 promotions recorded across the market. The overlap between high lateral hiring and elevated promotion volumes is notable. It suggests that firms were consciously balancing external recruitment with internal progression, reinforcing leadership depth while managing integration and cultural considerations.

What this suggests for 2026

The concentration of hiring in Q2 highlights where firms were prepared to invest when confidence was highest and strategic priorities were clearest. As firms move into 2026, we expect continued demand within these same core practices, particularly Real Estate, Corporate and Disputes, but with increased scrutiny on return, integration and long-term contribution.

Lateral hiring is likely to remain selective, with firms prioritising individuals who can demonstrate immediate strategic value, client ownership and cultural alignment. Promotion decisions are also expected to remain closely tied to performance and leadership needs, reflecting a continued focus on sustainability rather than scale.