Moderation in Hiring and Greater Selectivity

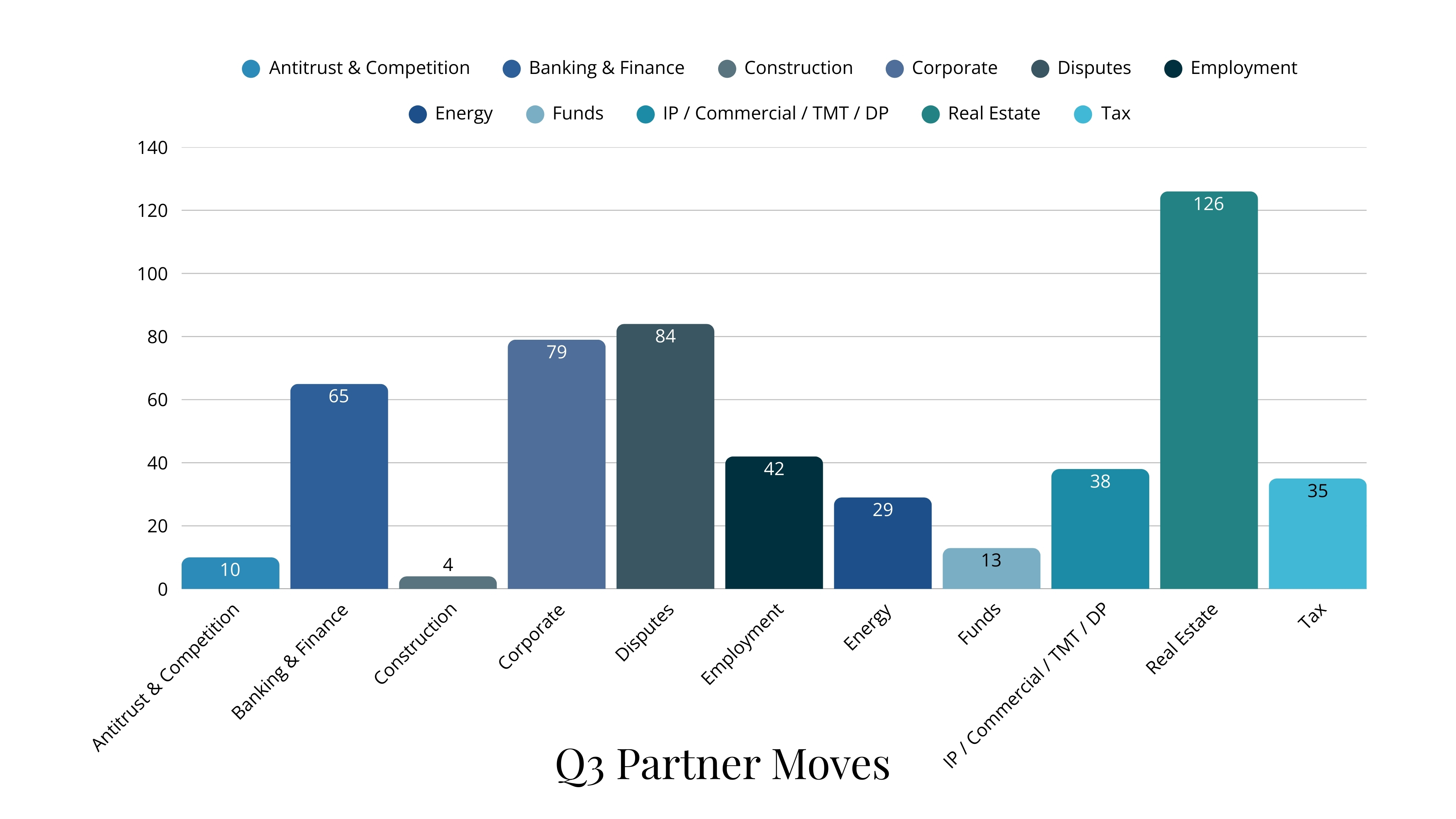

Partner movement moderated during the third quarter of 2025, with 490 partner moves recorded. This represented a clear deceleration from the elevated activity seen in the first half of the year and reflected both seasonal dynamics and a broader shift towards consolidation following an active start to the cycle. For many firms, Q3 served as a period of assessment rather than execution. Earlier hires were being integrated, performance was being reviewed, and leadership attention increasingly turned towards evaluating the effectiveness of investments made in Q1 and Q2. As a result, hiring decisions in this period were more selective and closely aligned to defined strategic needs.

Real Estate and Disputes remained relatively resilient. In Real Estate, continued movement was driven by specialist capability, particularly in areas intersecting with finance, restructuring and complex asset work. Disputes activity also held steady, supported by ongoing regulatory, commercial and cross-border matters that continue to generate sustained demand for senior contentious expertise.

By contrast, corporate hiring softened during the quarter. This was less a reflection of reduced confidence in the practice and more indicative of timing. Many firms had already addressed immediate corporate leadership needs earlier in the year, reducing the urgency for further lateral hires in Q3. Where corporate appointments did occur, they were typically targeted and opportunistic rather than programmatic.

Promotion volumes declined to 122 partner promotions, consistent with the completion of promotion cycles earlier in the year. Where promotions did take place, they were often concentrated within specialist or advisory practices, reinforcing the trend towards rewarding deep expertise and client-facing capability over broad-based expansion.

Cross-border movement remained stable during the quarter, with no material change in UK–US flows. This stability suggests that firms were largely comfortable with their international positioning at this stage of the year and focused more on internal consolidation than geographic rebalancing.

What this suggests for 2026

The moderation seen in Q3 underscores a pattern we expect to continue into 2026. Firms will remain open to hiring, but decisions are likely to be increasingly anchored in clear strategic rationale rather than momentum. Integration, performance and partner contribution are expected to feature more prominently in decision-making, particularly among firms that were active earlier in the cycle.

As a result, we anticipate a market in which fewer roles come to market, but where the bar for appointment remains high. Selectivity, leadership capability and alignment with long-term firm strategy are likely to define partner hiring behaviour into 2026.