Year-End Positioning and Market Discipline

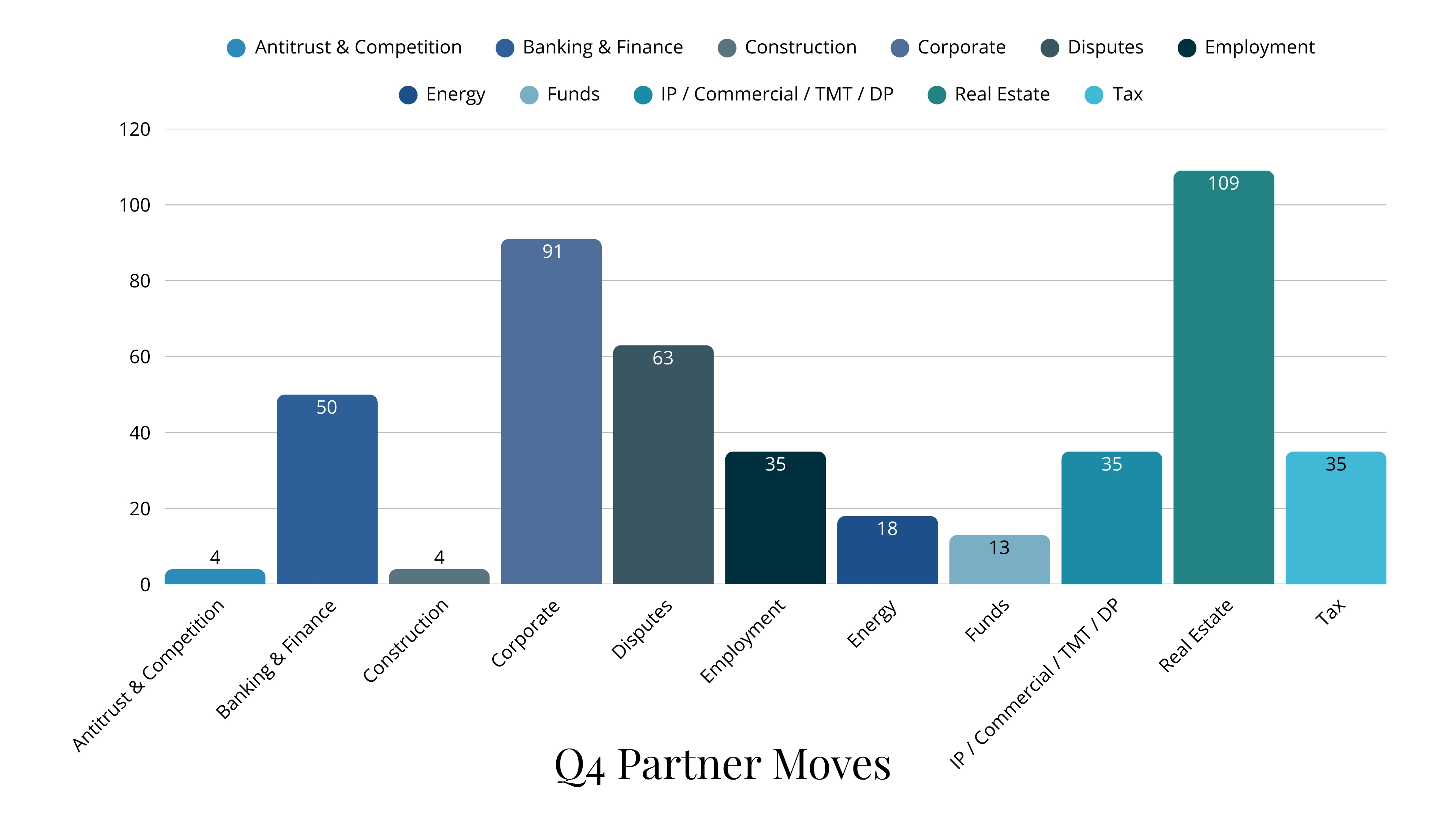

The fourth quarter of 2025 recorded 433 partner moves, making it the least active quarter of the year. This outcome was consistent with typical year-end patterns, as firms shifted focus away from execution and towards financial performance, budgeting and strategic planning for the year ahead. By Q4, most firms had already addressed their priority hiring needs. As a result, partner movement during the quarter was highly selective and often driven by timing rather than urgency. Decisions taken at this stage of the year tended to reflect long-term positioning rather than short-term opportunity.

Real Estate and Corporate continued to account for the largest share of activity, although hiring within both practices was notably targeted. In Real Estate, movement was concentrated around specialist capability, particularly where expertise aligned with financing structures, funds and cross-border asset work. Corporate hiring similarly focused on discrete additions, often linked to leadership depth or client coverage, rather than expansion.

Promotion volumes declined further in Q4, with 85 partner promotions recorded. This reduction reflected a conscious deferral of discretionary decisions, with many firms choosing to revisit promotion and investment discussions once new budgets and performance data became available in 2026. The restraint shown in promotion activity underscores the degree of market discipline evident at year-end.

Cross-border movement remained steady, with no late-year acceleration in UK–US flows. This stability reinforces the view that firms entered the end of the year broadly comfortable with their international platforms and did not feel compelled to make corrective moves ahead of the new financial year.

What this suggests for 2026

Firms entered 2026 largely settled in terms of partner composition, having completed the bulk of strategic hiring earlier in the cycle. As a result, early 2026 activity is expected to be opportunistic rather than corrective, with firms responding to specific client needs, succession considerations or market opportunities as they arise.

We expect partner hiring in 2026 to remain measured, with continued emphasis on integration, performance and long-term contribution. Where movement does occur, it is likely to be driven by clear strategic intent rather than volume, reinforcing the disciplined approach that characterised the latter part of 2025.