Early-Year Partner Activity Across UK and International Firms

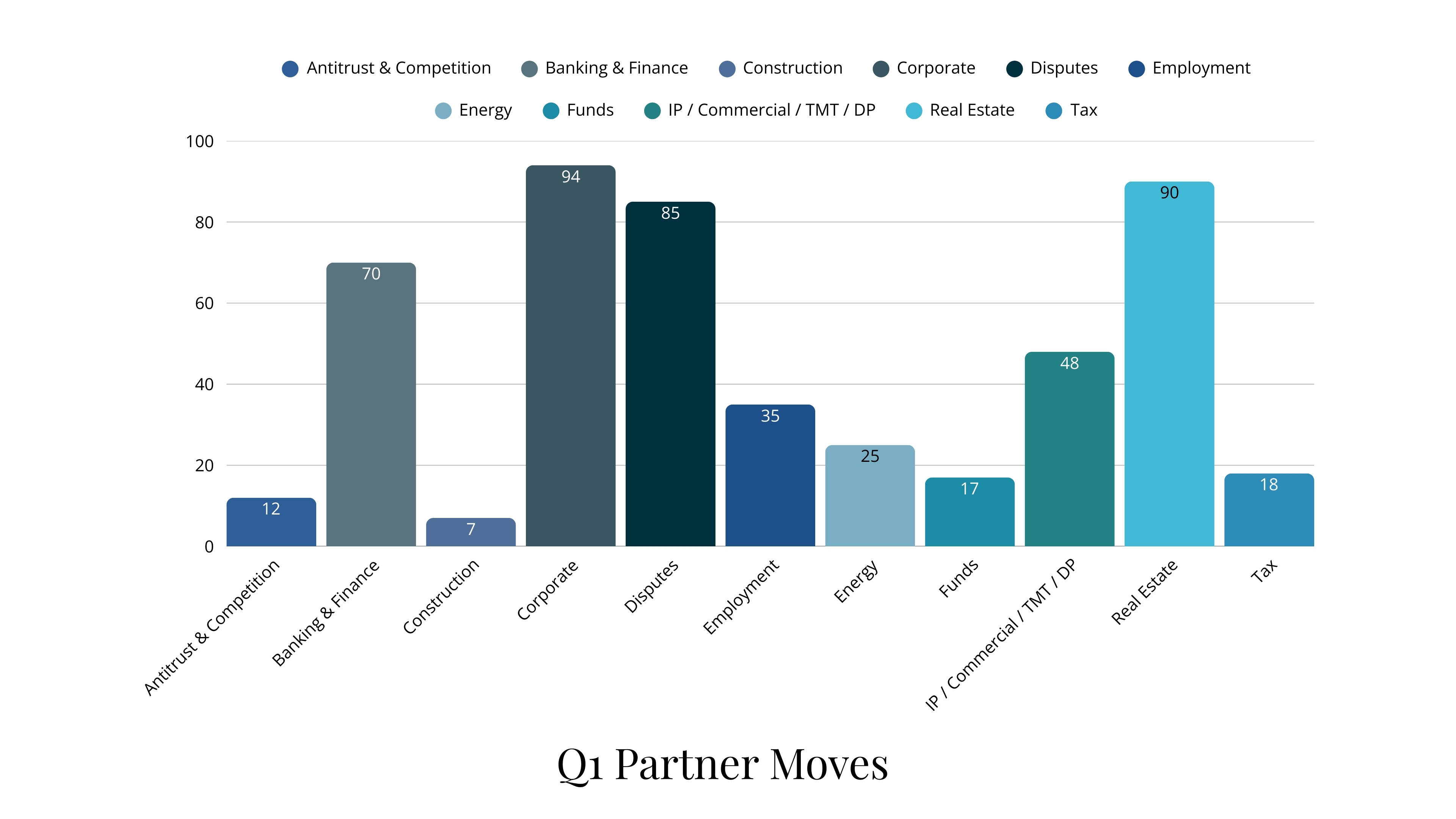

The first quarter of 2025 recorded 501 partner moves, reflecting the early execution of hiring strategies that had largely been shaped and approved in the latter part of 2024. As is often the case, Q1 activity was less about responding to new market conditions and more about implementing decisions where internal consensus had already been reached. Activity was concentrated in Corporate, Disputes and Real Estate, with firms acting decisively where strategic need had been clearly identified. This pattern was consistent across UK firms, Magic Circle practices and international platforms, suggesting a broadly aligned view of where leadership investment mattered most at the start of the year.

Corporate hiring was particularly visible. Among Magic Circle and international firms, much of this activity was directed towards reinforcing senior leadership rather than expanding overall headcount. In many cases, firms focused on partners capable of anchoring practices, managing institutional client relationships and providing internal stability. This reflects a wider shift in how firms assess corporate risk: leadership depth and execution capability are now prioritised alongside pure transactional capacity.

Disputes activity remained consistently strong throughout the quarter. The continued prominence of contentious hiring reinforces the view that disputes is no longer treated as a purely counter-cyclical practice. Instead, it has become structurally core for firms advising across regulated industries, financial services and complex cross-border matters. Q1 hiring suggests firms were keen to ensure disputes capability was firmly in place early in the year, rather than addressed reactively later.

Real Estate hiring also continued at pace, albeit with a clear emphasis on specialist capability. Rather than broad transactional expansion, firms prioritised partners operating at the intersection of real assets, finance, restructuring and funds. This reflects the evolving nature of real estate work and the increasing importance of partners who can advise across multiple asset classes and structures.

Promotion activity was notable in Q1, with 269 partner promotions recorded, concentrated primarily in Corporate and Disputes. The timing of these promotions is instructive. Promoting partners early in the year provides clarity around leadership, client ownership and succession before lateral hires are integrated. It also signals a continued commitment to internal progression, even as firms remain active in the lateral market.

Cross-border movement during the quarter was measured. UK–US moves occurred, but remained selective and individual, rather than indicative of broader platform shifts. This suggests that international firms entered 2025 broadly comfortable with their geographic positioning, focusing instead on incremental strengthening rather than expansion.

What this suggests for 2026

Early-year hiring behaviour tends to be a reliable indicator of firm intent. The Q1 2025 pattern points to firms entering 2026 with clear priorities and reduced appetite for experimentation. Where leadership gaps or succession needs are already visible, firms are likely to move early and decisively.

We expect early 2026 activity to follow a similar pattern: front-loaded hiring focused on core practices, selective lateral moves with clear strategic rationale, and continued emphasis on promoting internal talent where leadership continuity is critical.